In this article, we have compiled a list of useful tools and services for tracking illegal activities, crypto threats, and finding vulnerabilities in blockchain transactions. Most of the services include a comprehensive hack monitoring platform and process algorithm for the security of crypto wallets. In cryptanalysis, the control and analysis of transactions is always important to us. These services are useful, firstly, for detecting financial crimes associated with crypto wallets, secondly, for combating money laundering and thirdly for crypto-phishing threats, as well as eliminating bugs, errors and vulnerabilities.

Crypto risk assessment for individuals:

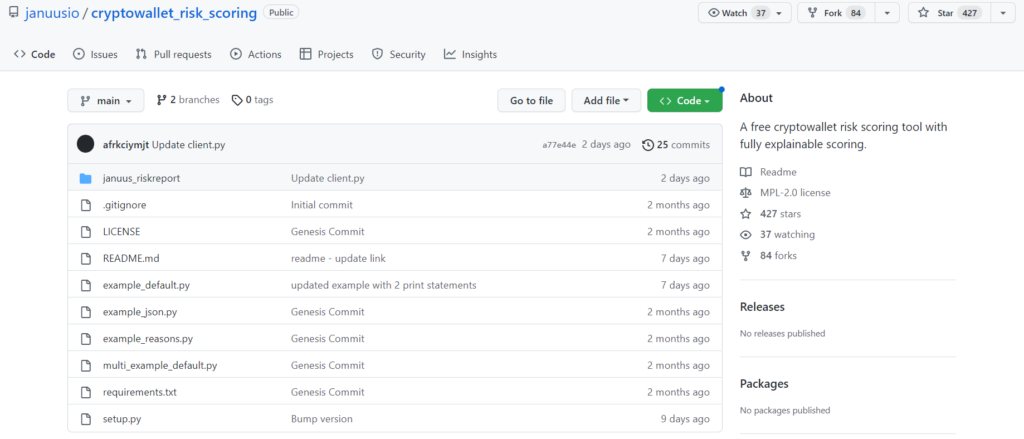

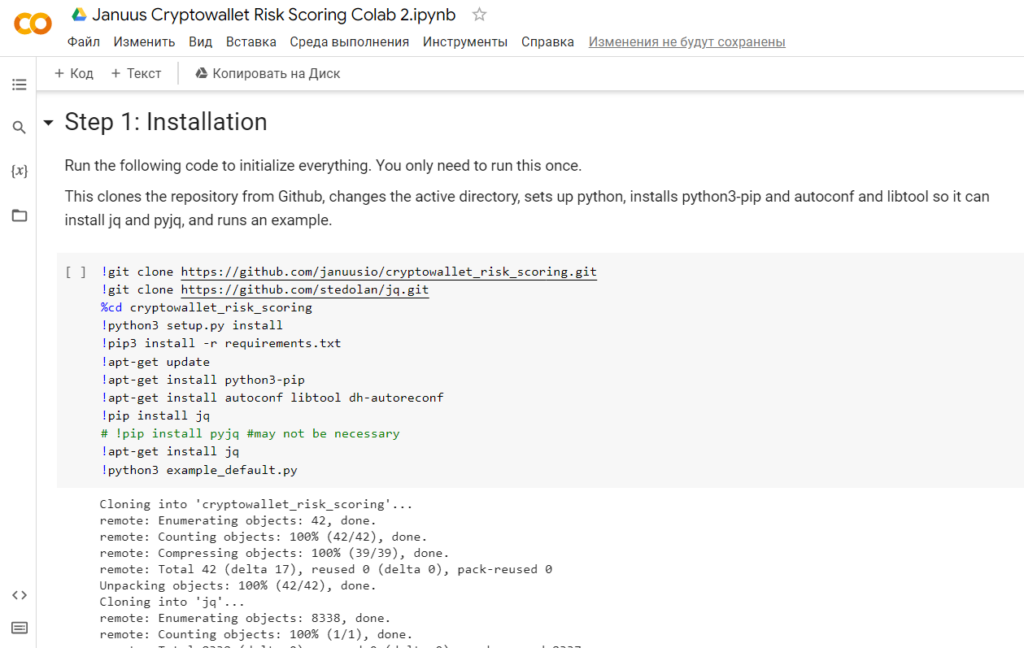

Janus

A free tool for assessing the risks of a crypto wallet, it helps to determine if a crypto wallet has made a transaction with an attacker, if it belongs to a scammer and if the wallet address is generally safe. It generates a fraudulent activity report of any Ethereum or Bitcoin Address based on the relevant identification data and transaction analysis and displays an audit trail for this report in pure JSON.

( free risk assessment via public GitHub repository )

Run in Google Colab works on any web browser

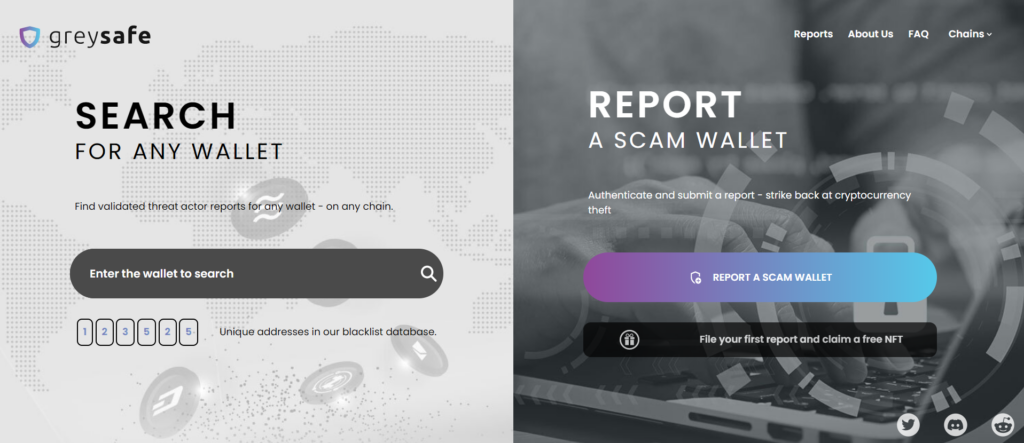

GreySafe is a community-driven crypto threat actor reporting service that accepts claims from all chains and focuses on their verification and accurate attribution.

Etherscan is an Ethereum block exploration and analytics platform that flags bad wallets.

Chainalysis is a blockchain data platform with a free sanctions API.

PeckShield blockchain security and data analytics company with plugin

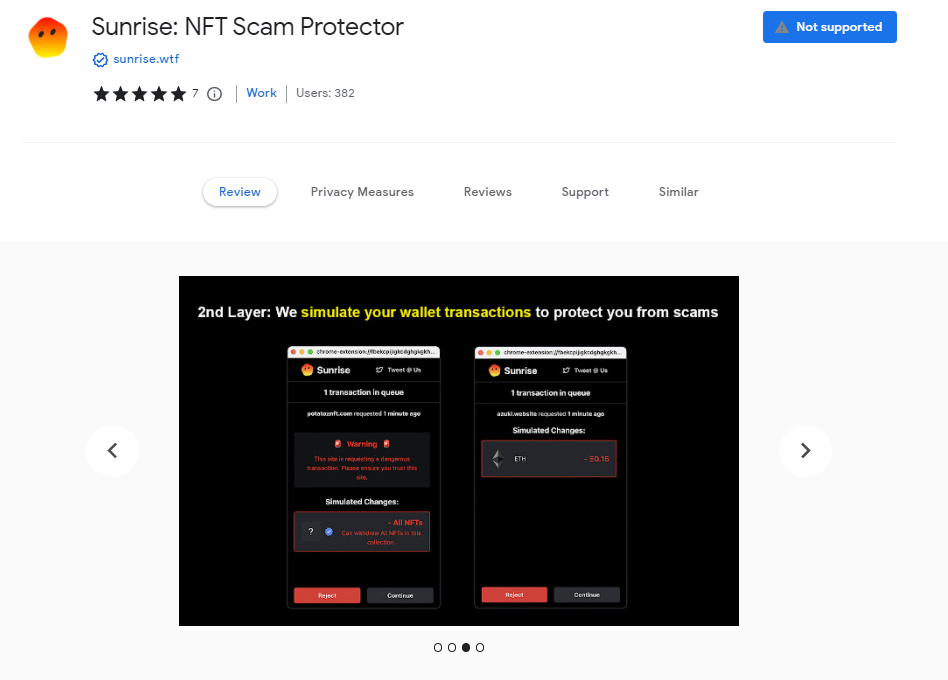

Sunrise: NFT Scam Protector

Sunrise.wtf Multi-layer NFT fraud protection plugin

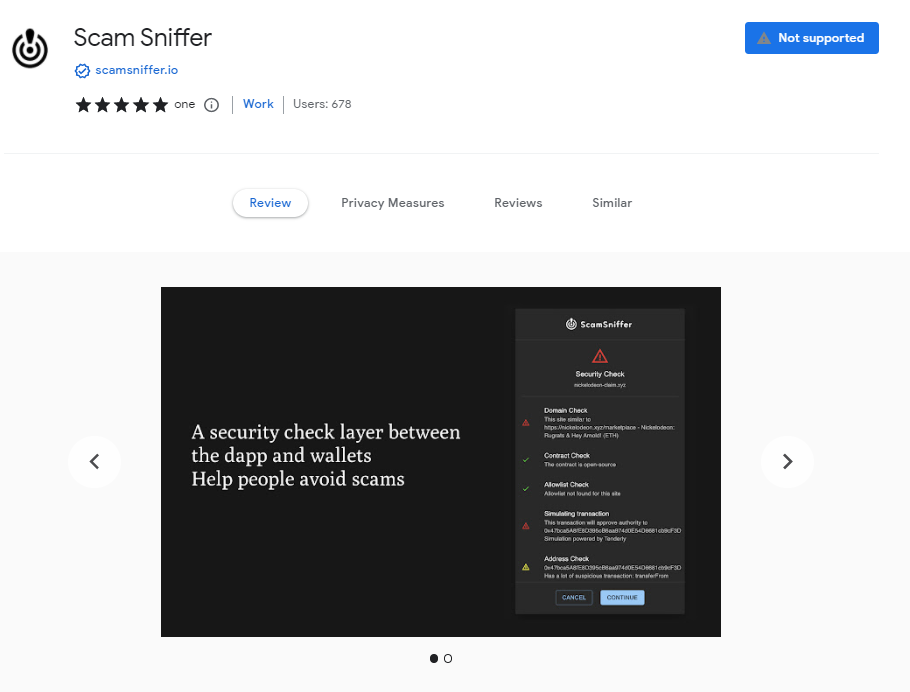

The ScamSniffer browser extension will alert you as soon as a phishing site is detected that poses a threat.

ClankApp explore the blockchain (ETH, BTC, DOGE) or try the free Crypto Wales API

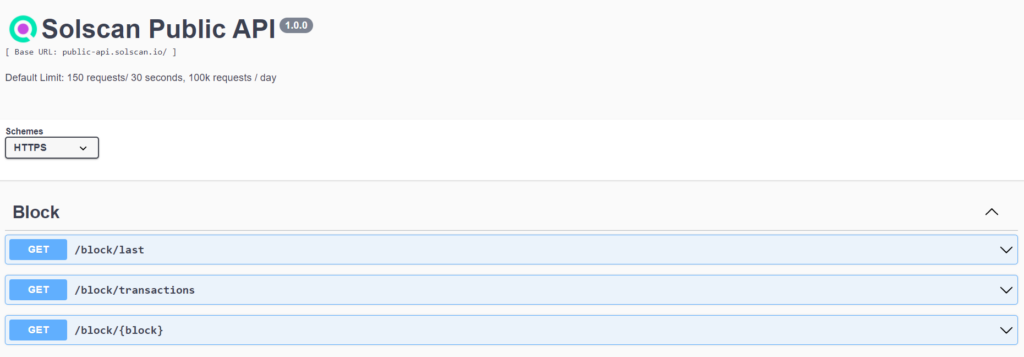

Solana Analytics Real-time updates to Solana Network statistics, including total transactions, TPS performance, total fees, blocks created, number of validators and voting accounts, and free APIs.

www.public-api.solscan.io/docs

Risk Assessment of Cryptocurrency Transactions on a Business Scale :

ScoreChain tracks crypto assets and helps us create a structured and consistent AML strategy to identify, evaluate and manage risk.

TruNarrative Client Registration in Multiple Jurisdictions, Financial Crime Detection, Risk and Compliance

Elliptic blockchain analytics and crypto compliance solutions

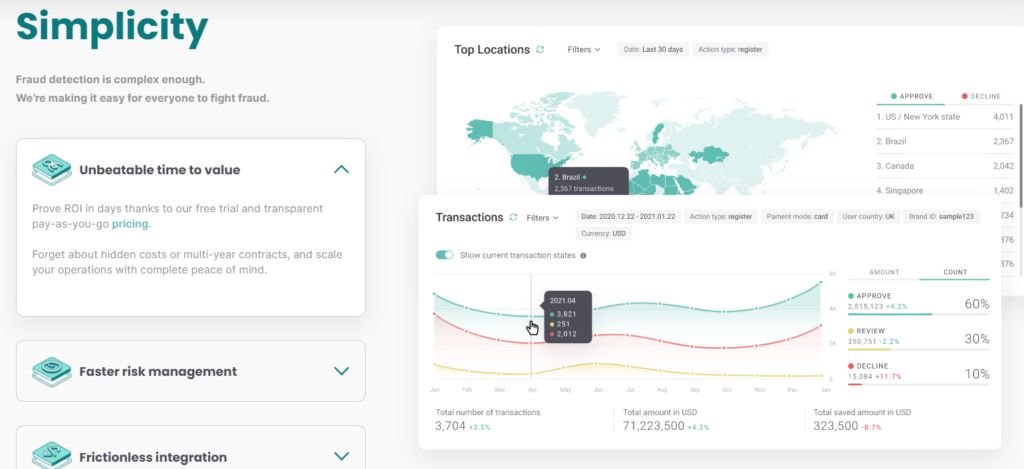

SEON gives us insight into every interaction, order, account, transaction and opportunity

Civic Identity Tools for web3, identity and age verification / Compliance tools make it easier for liquidity providers, dApp developers and institutional participants to manage risk and build trust

Global Ledger An anti-money laundering forensic firm that empowers banks, fintech and crypto-focused companies to achieve crypto compliance and mitigate money laundering business risks.

Acuant will help us instantly mitigate risks, prevent fraud and improve security

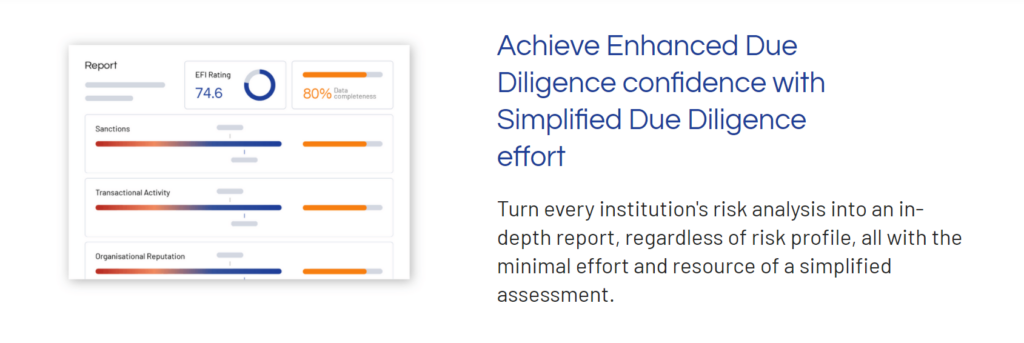

Elucidate A financial crime risk management firm, blockchain enabled platform provides a customized risk management solution.

Validus A comprehensive platform integrating surveillance, market risk monitoring, algorithm monitoring and AML/transaction monitoring.

Kinectify is an anti-money laundering and compliance software that includes streamlined tools to help us get to know each customer.

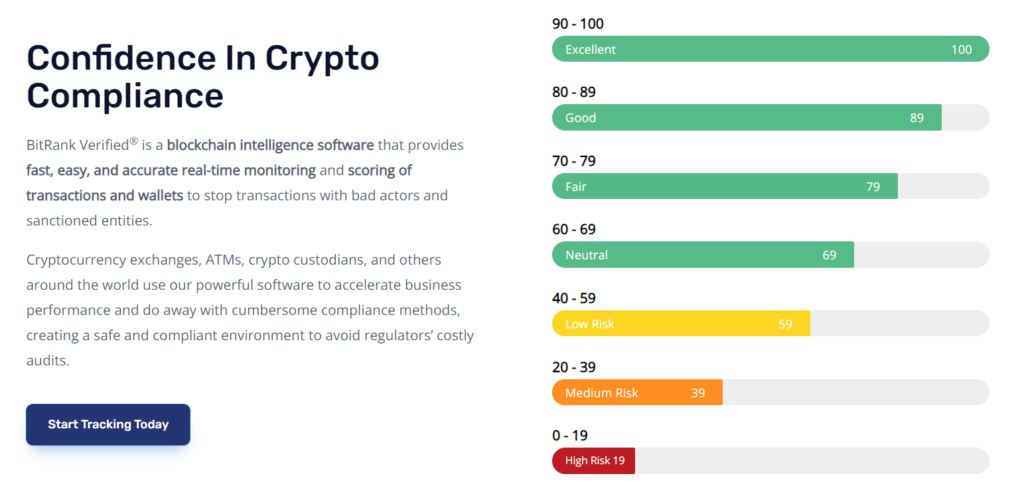

BitRank Automates Crypto Risk Scoring to Flag High Risk Transactions

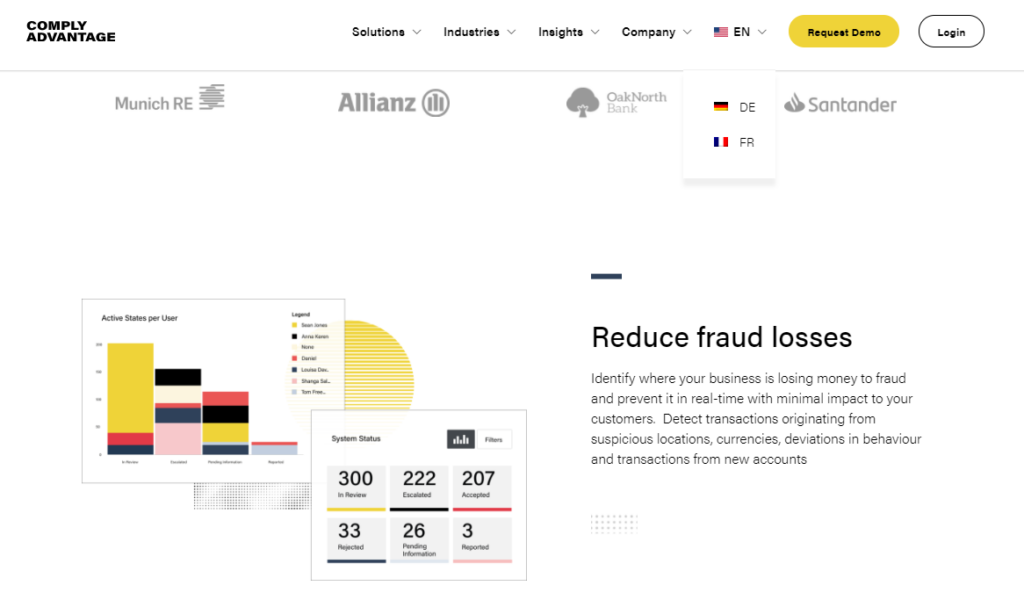

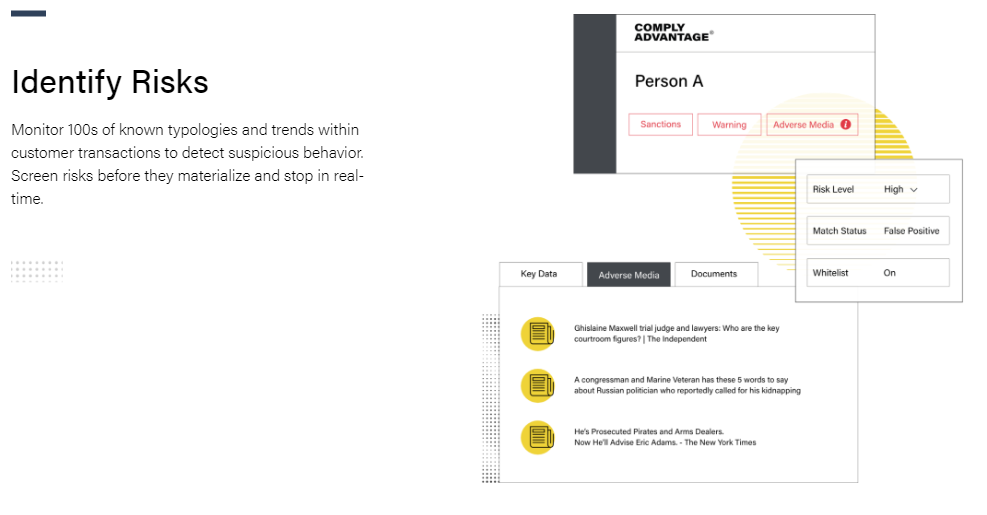

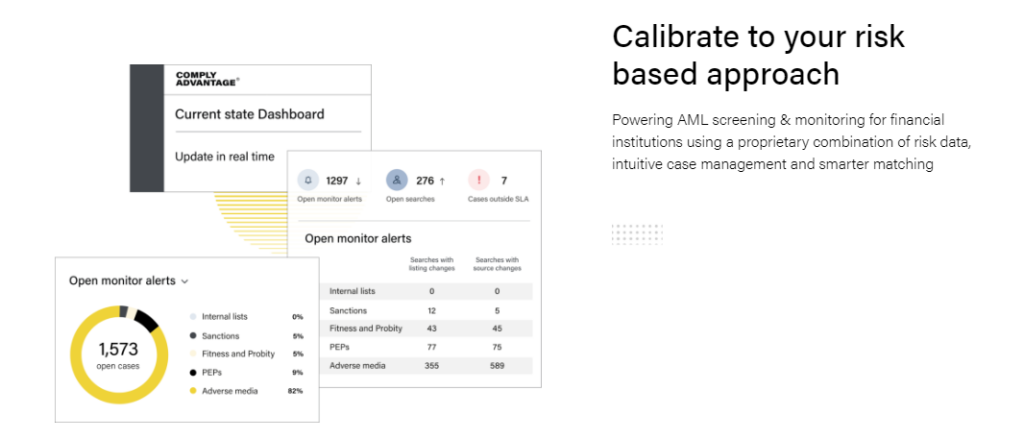

Comply Advantage Compliance advantage Easy categorization of risk classes Anti-money laundering data generation, a new invention

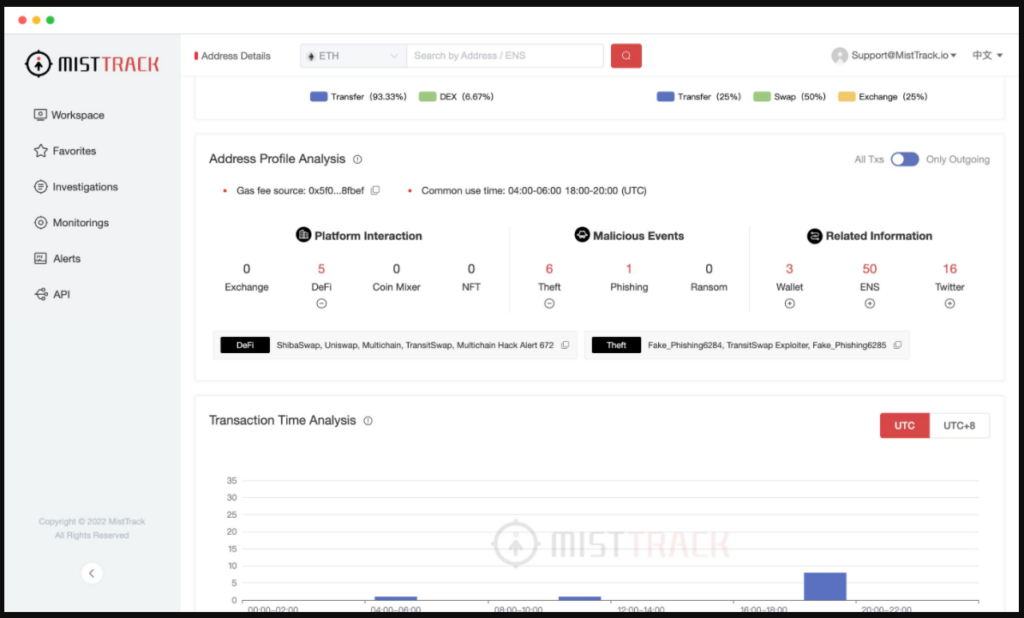

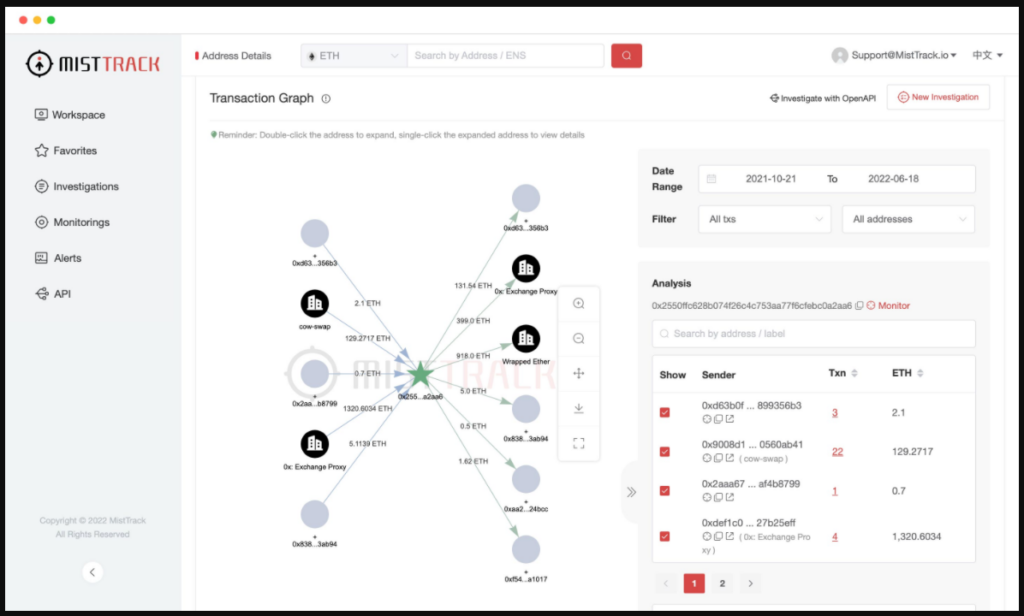

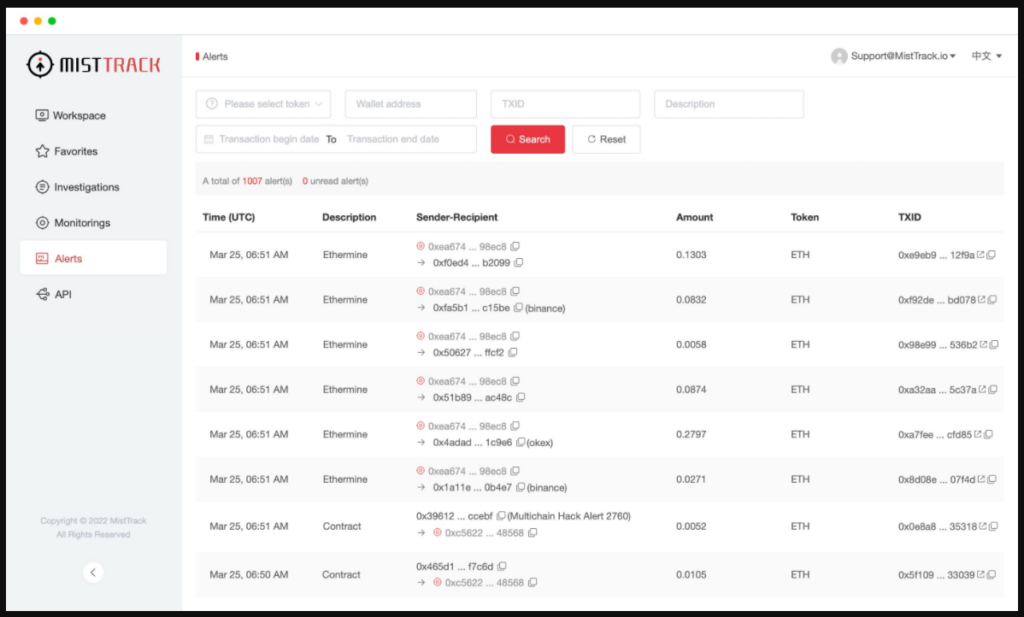

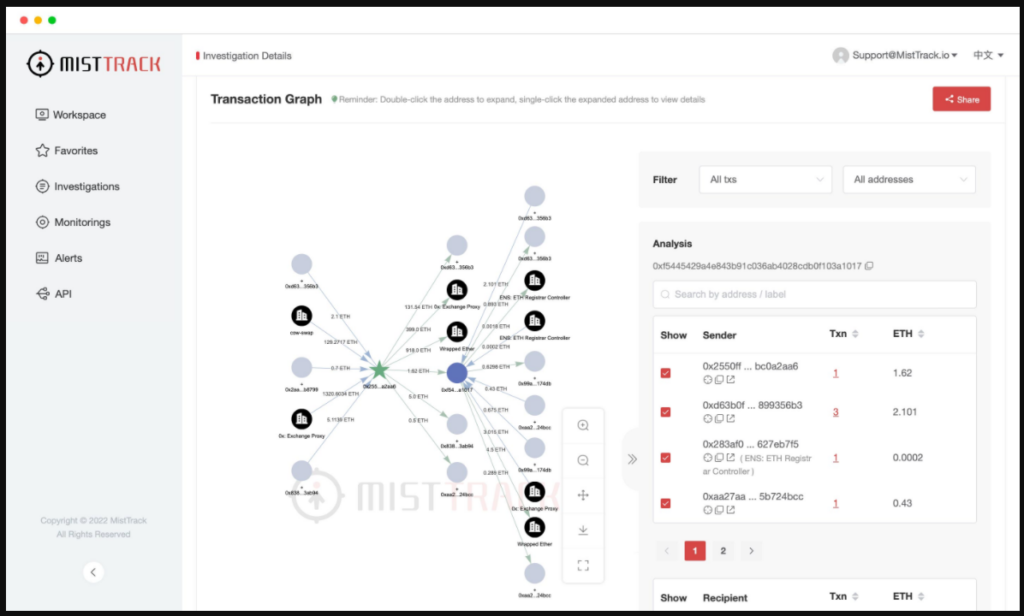

MistTrack is an anti-money laundering tracking system developed by the SlowMist team that uses web analytics to help track illegal funds.

List of cryptocurrency hacks since January 2021

At this rate, 2022 is likely to surpass 2021 as the biggest year for hacks on record. So far, hackers have made over $3 billion from 125 hacks,” Chainalysis, October 12, 2022, via Twitter

Analyst firm Chainalysis called October 2022 “the biggest month of the year with the biggest hacking activity,” with the total hack cost for the month nearly reaching $718 million.

Even though no more than half a month has passed, Chainalysis reported that 11 different decentralized finance (DeFi) protocol hacks have been used by hundreds of millions of people.

Cross-chain bridges are the biggest target for hackers, with three bridges accounting for 82% of losses in October this month. According to Chainalysis, the largest of these bridge hacks was an approximately $100 million exploit in the bridge between the Binance BNB Smart Chain crypto exchange and Beacon Chain.

Telegram: https://t.me/cryptodeeptech

Video: https://youtu.be/-s8Z6df_kxY

Source: https://cryptodeeptools.ru/crypto-risk-scoring